In the last 5 to 6 years, Ethiopia’s textile and apparel industry has grown at an average of 51% and more than 65 international textile investment projects have been licensed for foreign investors. The decision of the Ethiopian Government to prioritize the sector and design incentives to attract investment in view of worldwide competition has played a big role in the development of the sector’s economic status. This article was originally published in the 9th issue (January 2018) of The Ethiopian Messenger, the quarterly magazine of the Embassy of Ethiopia in Brussels.

Slow beginnings

Ethiopia’s long history of textile production began in 1939 when Dire Dawa Textile Factory, the first modern garment and textile factory of the country, was established. Later, Addis Garment PLC (formerly known as Augusta) was established in 1958. From then to 1991, the growth of the sector was sluggish; in fact, by 1991 there were only 19 textile and garment factories in Ethiopia, all owned by the State due to the command economic policy of the country.

Following Ethiopia’s adoption of a free market economy in 1991, the number of textile and apparel manufacturing companies increased to over 90. However, despite the government’s efforts, few transformational changes were witnessed in the sector until 2010.

A booming sector

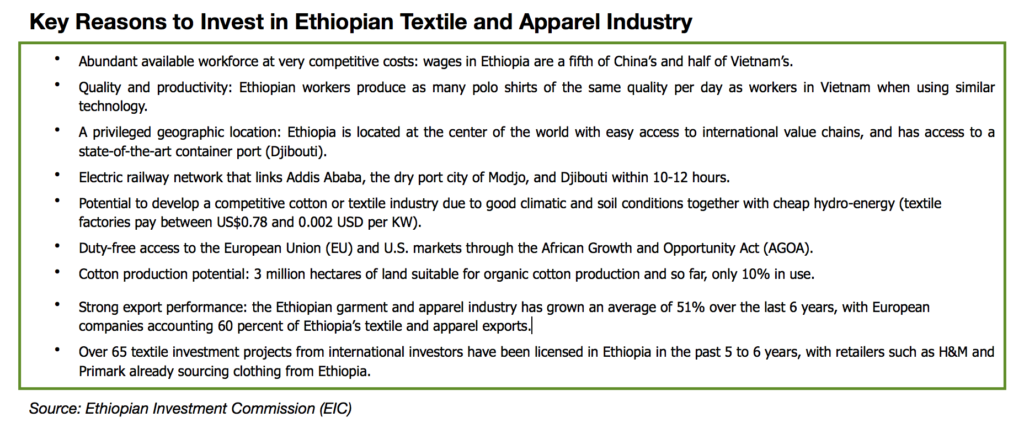

Ethiopia’s textile and apparel industry has experienced major development over recent years, mainly driven by the country’s wide availability of raw materials, cheap labour, low energy costs, and several bilateral trade agreements with the world’s biggest markets. Data shows that in the last 5 to 6 years, Ethiopia’s textile and apparel industry has grown at an average of 51%, and more than 65 international textile investment projects have been licensed for foreign investors during this period. This recent surge in Ethiopia’s textile and apparel production and export to the global markets shows that the country has the potential to become one of the leading textile and apparel hubs in Africa, capable of exporting the equivalent of 30 billion USD with a bold vision of transforming the nation into a compelling new apparel sourcing hub for brands, retailers and their supplier.

The sector has become a top priority for Ethiopia as part of its goal to become a middle-income country by 2025. The key objective is to make the sector globally competitive and to bring the necessary structural transformation to the nation’s economy to export industrial outputs, create thousands of jobs, attract much-needed foreign currency and above all, contribute to poverty reduction.

In the last 5 to 6 years, Ethiopia’s textile and apparel industry has grown at an average of 51% and more than 65 international textile investment projects have been licensed for foreign investors. The decision of the Ethiopian Government to prioritize the sector and design incentives to attract investment in view of worldwide competition has played a big role in the development of the sector’s economic status. At present, the Ethiopian textiles and apparel industry consists of approximately 188 medium and large-scale factories, 112 of which are foreign-owned. The total industrial sector in the country equals about 17% of the country’s GDP, with textiles and leather dominating the exports.

Industrial parks, strong infrastructure and convenient logistics facilities

Based on the Growth and Transformation Plan I and II, the government intends to construct 15 export-geared, state-of-the-art and eco-friendly industrial parks in different regional states’ main cities. Five are already operational and two will be inaugurated in the upcoming months. In addition, one private industrial park built by a Chinese company in the Eastern Industrial Zone is operational and seven more are under construction, among which one is dedicated to textiles and apparel. All parks have an international standard building with high infrastructure, safety facilities and low carbon footprint. They also boast a wide range of government facilities on site under the Ethiopian Investment Commission’s one-stop service from banking to visa and immigration facilities, import and export licenses, work permits and customs clearance, etc.

Among other things, the cluster of specialised operational state-run parks, the Hawassa, Mekele, Bole Lemi, Kombolcha parks and the Adama Industrial Parks are also dedicated to textile and apparel. The flagship eco-friendly Hawassa Industrial Park, which is dedicated to textile and apparel manufacturing industries, encompasses 1.4 million square meters, 410,00 square meters of factory spaces across 37 shades, making it Africa’s largest manufacturing park with 100% occupancy secured from the very beginning. The park is planned to generate 1 billion USD foreign currency per year and employs 60,000 workers at its fullest operational capacity.

These initiatives have already attracted several international investors. Among the firms currently setting up operations in the Hawassa Industrial Park are: PVH Corp, owner of the Calvin Klein and Tommy Hilfiger brands; Hong Kong-based dress shirt specialist TAL Apparel; Indian denim giant

Arvind Ltd, Chinese fabric mill Wuxi Jinmao; Indonesian Busana Apparel Group in garments; Hong Kong garments company EPIC; British Hela Clothing Group, the Spanish Quadrant Apparel Group PLC and Best Corporations Indian Private Limited Textile Company.

Transport infrastructure is constantly improved: the newly built electric railway network that links Addis Ababa, the dry port city of Modjo, and Djibouti reduced cargo transit times from three days by road to 10-12 hours by train and rail corridors that will make up a 6000 kilometres network are underway to create a series of trade routes to neighbouring Kenya, South Sudan and Sudan are being built. In addition, Ethiopian Airlines, the largest and the fastest-growing airline in Africa, plays a key role in the logistics process.

Incentives of the sector

The textile sector is open to foreign investors and Ethiopian Diaspora. The minimum capital required for a foreign investor is 200,000 USD per project, and if a foreign investor invests in partnership with a domestic investor, the minimum capital required is 150,000 USD per project. The land will be given on a lease basis and the lease payment differs on the location of the investment. However, the government encourages foreign investors to invest in the newly built textile and apparel specialized parks that are located along key economic corridors, connected to ports by electric-powered railway lines and roads with lucrative incentive packages.

In addition, the Government provided the following incentives to encourage investment in the sector:

– Up to 10 years corporate exemption of income tax depending on sector engagement;

– Up to 6 years exemption depending on sector engagement;

– Additio=nal 2-4 year exemption for industrial park enterprises with at least 80% export or input supply to exporters;

– Additional 2-year exemption for 60% exporters or input suppliers to exporters within or outside of industrial parks

– Additional 30% deduction for 3 consecutive years if the investment is in underdeveloped regions.

– Up to 5 years personal income tax exemption for expatriate employees of industrial park enterprises (tenants) following the issuance of a business license.

– 60-80 years of land lease right at a promotional rate; with sublease right for industrial parks enterprises.

-Reliable electricity at global competitive rate government avails dedicated power substation for industrial parks.

Regarding customs duty

– 100% exemption from the payment of customs duties and other taxes levied on imports is granted to all capital goods, such as plant, machinery and equipment and materials;

– Spare parts worth up to 15% of the total value imported of the imported investment capital goods, provided that the goods also exempt, from payment of customs duties;

– An investor granted with customs duty exemption will be allowed to import capital goods duty-free indefinitely

– An investor entitled to a duty-free privilege buys capital goods or construction materials from local manufacturing industries shall be refunded customs duty paid for raw materials or components used as inputs for the production of such goods;

– Investment capital goods imported without the payment of customs duties and other taxes levied on imports may be transferred to another investor enjoying similar privileges.

Exemptions of Customs Tax and Duties on raw material through a set of incentive schemes: Duty drawback, Voucher, Bonded manufacturing warehouse and on-site (factory) custom inspection of imported raw materials and exportable products.

A fast-growing export market

When it comes to international exports, Ethiopia is now at one-third of the use of its capacity and one-tenth of potential export value. Given the forecasted growth of the population (which is expected to double to 180 million inhabitants in 2025-2030), the sector will need to grow rapidly and

Desta PLC’s textile manufacturing facility located in Addis Ababa

mature a lot faster than other developing nations. The Ethiopian government plan for the sector to reach maturity in the upcoming 5-10 years, which is three times faster than other emerging nations. In that sense, Ethiopia differs a lot from nations like Bangladesh, for instance, where the sector has come to blossom with an active intervention of government, making the local market much more attractive for Ethiopian textiles and apparel companies.

In recent years, the global market has become increasingly accessible to countries such as Ethiopia. New export opportunities were created through initiatives such as AGOA (the African Growth and Opportunity Act), COMESA (the Common Market of Eastern and Southern Africa) and the many bilateral trade agreements concluded with Western countries, including the Netherlands, Belgium and Luxembourg. Ethiopia is also part of the “Everything But Arms” program that has been set up to provide access to the EU market for Lesser Developed Beneficiary Countries, free of duty and without quota restrictions, for all export products except arms.

Textiles and apparel exports from Ethiopia have increased substantially over the last decade. Based on figures from the Ethiopian Revenue and Customs Authority, Ethiopia’s textile industry obtained about $89.34 million worth of exports in the 2015/2016 fiscal year. According to the Ethiopian Textile Development Institute, Ethiopia has currently five major public textile factories producing mostly workwear garments for the domestic market, while about 180 privately-owned local and international factories produce shirts, suits, work clothes and uniforms for national and foreign markets.

Verticalisation and social and environmental responsibility

Verticalisation is another factor the government has considered in creating a fully vertical supply chain from the ground up. The full cycle of textile business opportunities is encouraged in Ethiopia and more than 50,000 hectares of cotton is under cultivation, while an additional 45,000 hectares of high-quality cotton is cultivated by small-scale farmers. The production of cotton is already well integrated into the textile sector, with garment factories relying heavily on domestically-produced cotton.

Textile and apparel companies operating in Ethiopia are also obliged to meet the social and environmental requirements of their buyers which demand certifications based on their performance on the ground. The Industrial Parks Development Corporation makes sure that the parks are eco-friendly and that these facilities are in place in usage. The Ministry of Labor and Social Affairs also ensures that the textiles and apparel companies’ labour recruitment, benefits, occupational health and safety comply with the labour law of the land.

Besides, international institutions like Swedish apparel giant H&M, the International Labor Organisation (ILO) and the Swedish International Development Cooperation Agency (SIDA) have launched an industrial relations project aiming to improve the development of a socially sustainable textile and apparel industry in Ethiopia. They are also dedicated to providing training and technology transfer in the sector, which all stand in favour of boosting Ethiopia’s textile and apparel industry.

Promising context and remaining challenges

Over 80 years of development, Ethiopia’s textile and apparel industry has transformed from one of the country’s least developed sectors to today’s fully integrated industry and value chain with a significant contribution to the nation’s GDP.

Meanwhile, the government of Ethiopia has also been taking actions to encourage investment in this sector and has created various incentives to support the industry and due to this many international apparel companies are making their preferred investment and sourcing destination to Ethiopia.

As we have seen, the major strengths of Ethiopia’s textiles and apparel sector are the very high commitment of the government in support of the sector, the availability of abundant labor at low cost, cheap electricity costs and goods and the many incentives put in place by the government (tax holidays, income tax holidays up to 2 years for expatriate technicians, integration possibilities with raw materials) as well as fast and convenient transportation infrastructure. Existing challenges are related to the immaturity of the sector and its actors, such as the limited availability of raw materials and the inefficiency of digital processing in business.

Therefore, the Ethiopian Government highly encourages and welcomes the Ethiopian Diaspora and foreign investors and traders to source and invest in textile and apparel industry independently or in a joint venture with preference in textile and apparel parks. ■